Re: La nueva Repsol (REP) sin YPF

Y a estos precios. ¿Que veis mas interesante? Adquirir las acciones? Vender los derechos al mercado? O vender derechos a la compañia?

Gracias

Y a estos precios. ¿Que veis mas interesante? Adquirir las acciones? Vender los derechos al mercado? O vender derechos a la compañia?

Gracias

Salirse de ella pitando.

Todo lo contrario !!!!!

Vamos a cerrar el gap y poco más...

En unos meses me lo cuentas !!!! ;-)

Estoy incluso por decirte que subiremos a contracorriente del Ibex... verás a SAN en los 3,80-4,00€ en poco tiempo y a Repsol subiendo en modo cohete.

Saludos

P.D.: Cuando veas los 3,80 de SAN es el momento de llenar la despensa !!!!

Sigue la sangria. Habra hasta q pensarse entrar en los 10E

Personalmente he invertido aqui para hacer como en tef o cualquier otra que quiera darme papelitos, cobrar los dividendos en metalico vendiendoles mis derechos. Ni me paro a pensar lo que me sale mas rentable, soy demasiado vago jejejeeje.

yo esperando los 10 para entrar , tal como estan las cosas yo creo que los 10 los toca seguro , ahora el dilema es que no baje mucho más, espero no tener que ver precios por debajo de 9, en 9 seria mi proxima compra

BD, parece que la cosa se estabiliza y la sobreventa es brutal.

Ojo que si aguanta cerca de los 11 es posible que nos vayamos otra vez a los 12 la próxima semana (antes del reparto del divd).

Está todo muy difícil pero parece lógico que esta sobreventa se disipe y recupere algo.

En estas circustancias difícil dar pronósticos. Está todo al 50%, así que cada cual haga lo que crea.

Si finalmente consigue aguantar será bueno para el futuro ya que los mínimos serían casi 1 euro por encima de la vez anterior.

suerte

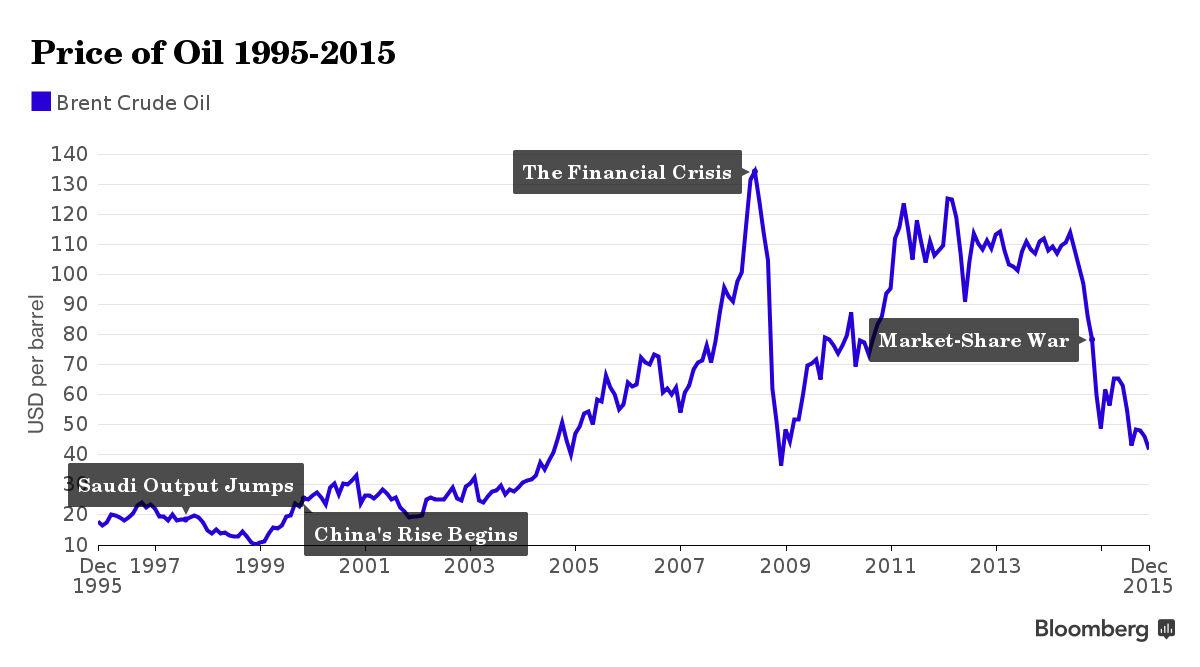

OPEC has dropped any attempt at trying to fulfill its founding mission and manage the oil market, sending global benchmark Brent crude to a six-year low. For Saudi Arabia’s Ali al-Naimi, the most powerful and longest-serving of the group’s oil ministers, it may have seemed like history was repeating itself.

There are several striking parallels between the Organization of Petroleum Exporting Countries’ current situation and the period from 1997 to 1999, when the group lost control of the market and oil slipped to less than $10 a barrel. While investors may wonder whether markets will follow a similar trajectory this time, it’s important to remember that OPEC emerged from the crisis to see oil prices surge all the way to almost $150 a barrel. If the parallels hold, markets could be in for a wild ride.

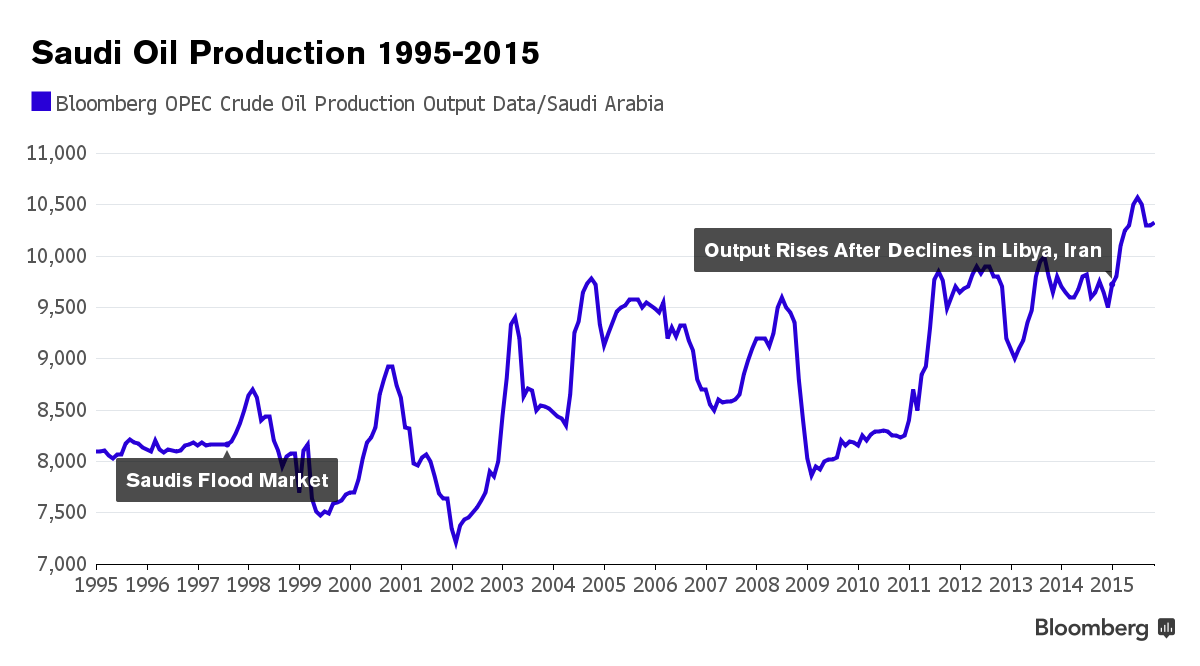

Nearly two decades ago, Venezuela had a growth spurt that lifted its output from 2.2 million barrels a day in 1992 to 3.5 million barrels a day six years later. Saudi Arabia responded by increasing its own production, flooding the market. This time around, Saudi Arabia has embarked on a production spree -- pumping a record of 10.6 million barrels a day earlier this year -- while Iran plans to boost daily output by as much as 1 million barrels next year after sanctions are lifted.

As OPEC lifted production in 1997, Asia headed into economic meltdown. The devaluation in July that year of the baht, the currency of Thailand, triggered a financial crisis that pushed Indonesia, Malaysia, Philippines, Singapore and Thailand into recession. The group’s GDP contracted 8.3 percent in 1998, compared to growth of 7.5 percent on average the previous decade, according to data from the International Monetary Fund. While Asia isn’t collapsing this time around, China is experiencing the slowest expansion in 25 years.

Back in 1997, OPEC decided at a meeting in the Indonesian capital to raise production quotas just as the Asian economic crisis began, sending oil prices as low as $10. Veteran oil ministers still refer to the “ghost of Jakarta” that haunts their decisions. Indonesia has now returned to the center of OPEC after the nation rejoined the group last week after suspending its membership in 2009.

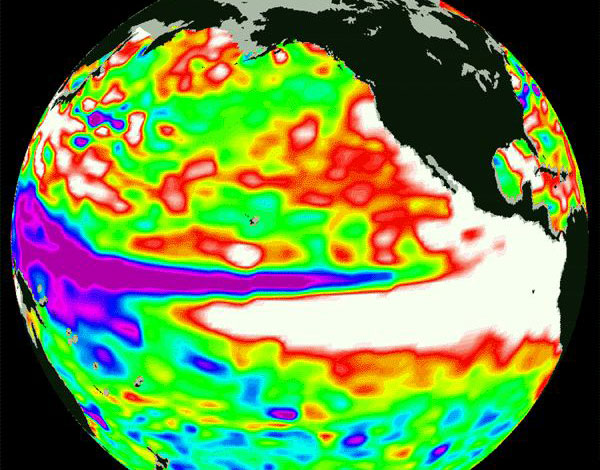

The oil slump of 1997 to 1999 was compounded by El Nino, which curbed demand for heating fuel by warming the ocean surface in the equatorial Pacific and making fall and winter in the Northern hemisphere milder than normal. Fast forward to 2015 and El Nino is already comparable to the record events of those years, according to the Bureau of Meteorology of Australia. Heating oil stockpiles in the U.S. and northern Europe are high, potentially affecting overall crude demand.

Just as they were nearly two decades ago, Saudi Arabia’s al-Naimi and Iranian Oil Minister Bijan Namdar Zanganeh stand in opposition across the conference table in Vienna. Both have a long history of working together to resolve oil gluts, but the differences loom larger this time as their nations’ conflicting positions on Syria, Yemen and Iraq get in the way of the business of oil.

Venezuela saw an abrupt political change in December 1998 when Hugo Chavez won presidential elections, ushering in a new era of socialism and triggering an oil u-turn. Chavez joined Saudi Arabia in cutting production, ending a decade of increases, while his policies slowly drove out many of the country’s foreign oil investors. After 16 years of uninterrupted “Chavismo,” the nation’s crude production has fallen by 10 percent and the opposition has just won its first elections, taking a majority in Congress.